Back to blogs

Learn

Not all crypto loans are made the same

By Josip Rupena

September 25, 2025 • 6 min read

When most borrowers shop for loans, the instinct is to chase the lowest interest rate. That logic works in traditional finance, where loan structures are standardized. A 30-year mortgage from one bank is more or less the same as one from another, so comparing by APR is sensible.

In crypto, this mindset can be dangerous. Two loans advertising similar rates may operate under completely different mechanics. One might lock in your rate and repayment schedule for the entire term. The other might change your rate overnight or trigger a liquidation because of how it relies on blockchain oracles. On the surface, they look comparable. Underneath, they couldn’t be more different.

The danger of applying traditional finance logic to crypto lending

Traditional finance conditions us to treat loans as interchangeable products. A personal loan is a personal loan, and the only real difference is whether Bank A offers 6.5 percent while Bank B offers 7 percent.

Crypto lending does not work that way. Loan design itself, whether open-ended or fixed, decentralized or regulated, collateralized through smart contracts or with a custodian, shapes the borrower’s risk profile far more than the stated rate.

If crypto lending is to stand as a true alternative to traditional finance, it must be evaluated on structure before sticker price.

The core loan models shaping the market

a. Open-term decentralized loans

These are common across DeFi platforms. Borrowers pledge crypto into smart contracts, receive funds from liquidity pools, and pay interest that accrues continuously. Rates are algorithmic and can swing within a single day. There is no fixed maturity date, which gives borrowers the flexibility to repay anytime.

The trade-off is volatility. Oracle-based pricing can trigger sudden margin calls. Liquidity providers can withdraw, creating rollover risk. Morpho is one example of this model, where rates and risk can change quickly depending on market conditions.

b. Structured regulated loans

This model takes a more familiar form. Borrowers agree to clear terms at origination, such as fixed interest rates and predictable repayment schedules. Collateral is held with regulated custodians and is not rehypothecated. Products are often designed for real-world use cases like property purchases or refinancing.

Milo is one example of this approach. Its loans include 12-month crypto loans and 30-year crypto mortgages, both interest-only with fixed rates. Collateral is custodied with BitGo or Coinbase, and terms remain consistent through the life of the loan.

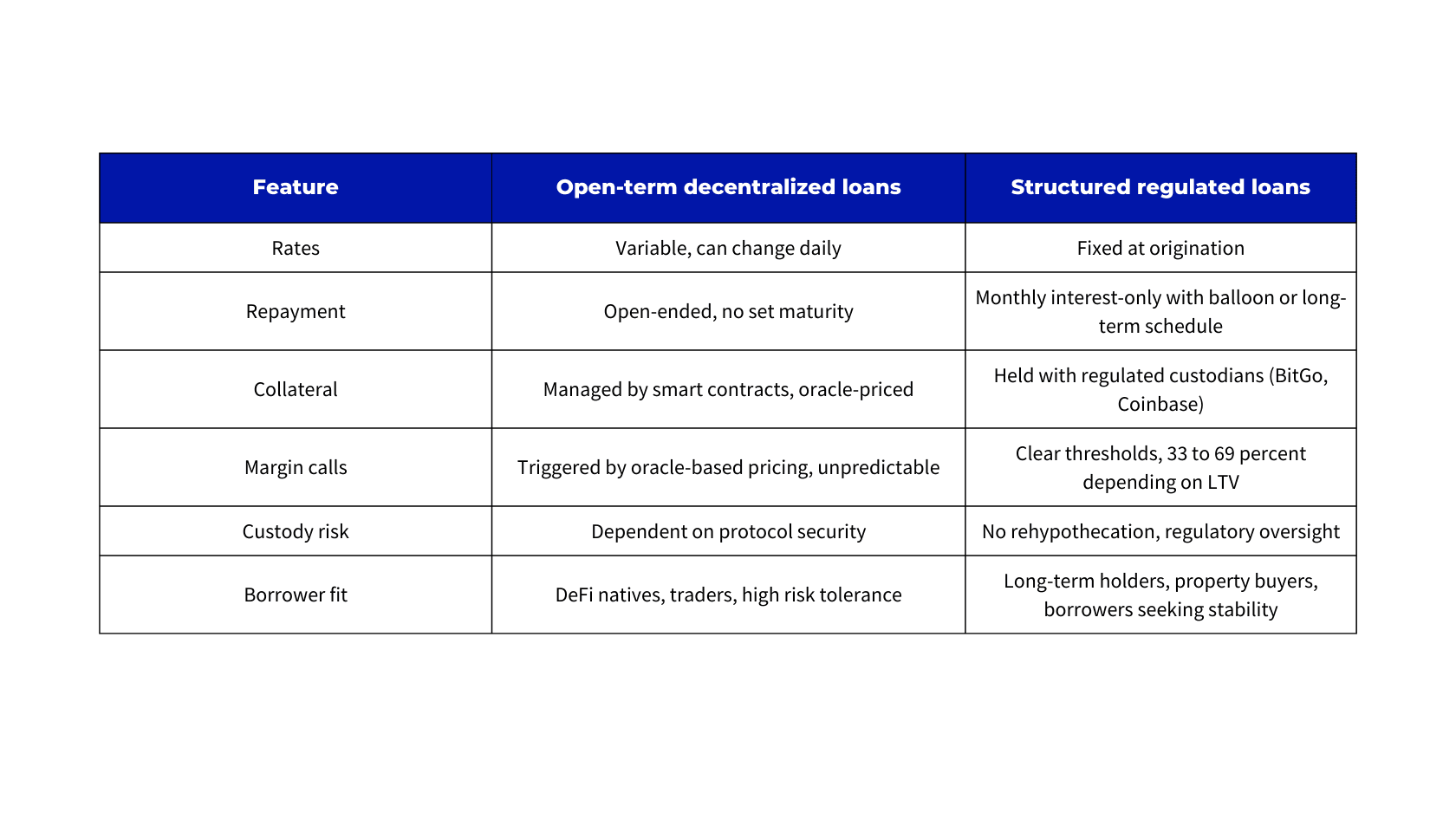

Key differences every borrower should understand

Which crypto loan model is best suited for you?

-

Open-term decentralized loans: Best for DeFi natives who want maximum flexibility and are comfortable with volatility. These borrowers can manage risks in real time and often use loans for short-term liquidity or trading strategies.

-

Structured regulated loans: Best for borrowers who want predictability and long-term utility, such as financing real estate. These borrowers prefer fixed rates, regulatory oversight, and custodial security to support bigger life decisions.

The future of crypto lending

If crypto loans are evaluated only by APR, the industry risks recreating traditional finance in a more volatile wrapper. The real innovation lies in the diversity of loan structures, not just their cost. Borrowers should ask:

- Do I want flexibility or stability?

- Am I comfortable with smart contract and oracle risk?

- Do I need open-term liquidity or fixed-term predictability?

Not all crypto loans are made the same. The market will mature when borrowers learn to judge lending products not by price alone but by design, security, and alignment with long-term goals.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Josip Rupena

CEO / Founder at Milo

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.

Related articles

Crypto Mortgage

Crypto loans vs. traditional financing: key differences explained

By Colin McMahon

March 12, 2025 • 8 min read

Crypto Mortgage

Best U.S. Crypto Loan Lenders in 2025: Rates & Features Compared

By Colin McMahon

May 14, 2025 • 6 min read

Learn

The truth about borrowing against digital assets

By Colin McMahon

March 27, 2025 • 6 min read