Get the cash you need

for major milestones, real estate,

or business investments

Investment

Feeling bullish? Use a loan, get cash and buy more crypto. Pay off the principal when your crypto appreciates in value.

Home upgrades

Renovate your home and kick off a new home improvement project.

Downpayment

Get cash to buy your dream primary home - even if you are using another mortgage lender.

Find the right crypto loan solution

Leverage your digital assets without selling them. Whether you're investing in real estate or need funds for immediate goals, our crypto solutions offer competitive rates and flexible terms—all secured by trusted custodians.

Ready to purchase or refinance a property? Explore a crypto mortgage instead.

Our products

Crypto loan

Crypto mortgage

Use case

Downpayment for primary property

Second or investment properties

Rate

As low as 10.75%

(12.75% APR)

8% - 10%

Collateral required

2x loan amount

1x property value

Secure custodian

BitGo & Coinbase

BitGo & Coinbase

Prepayment penalty

No

No

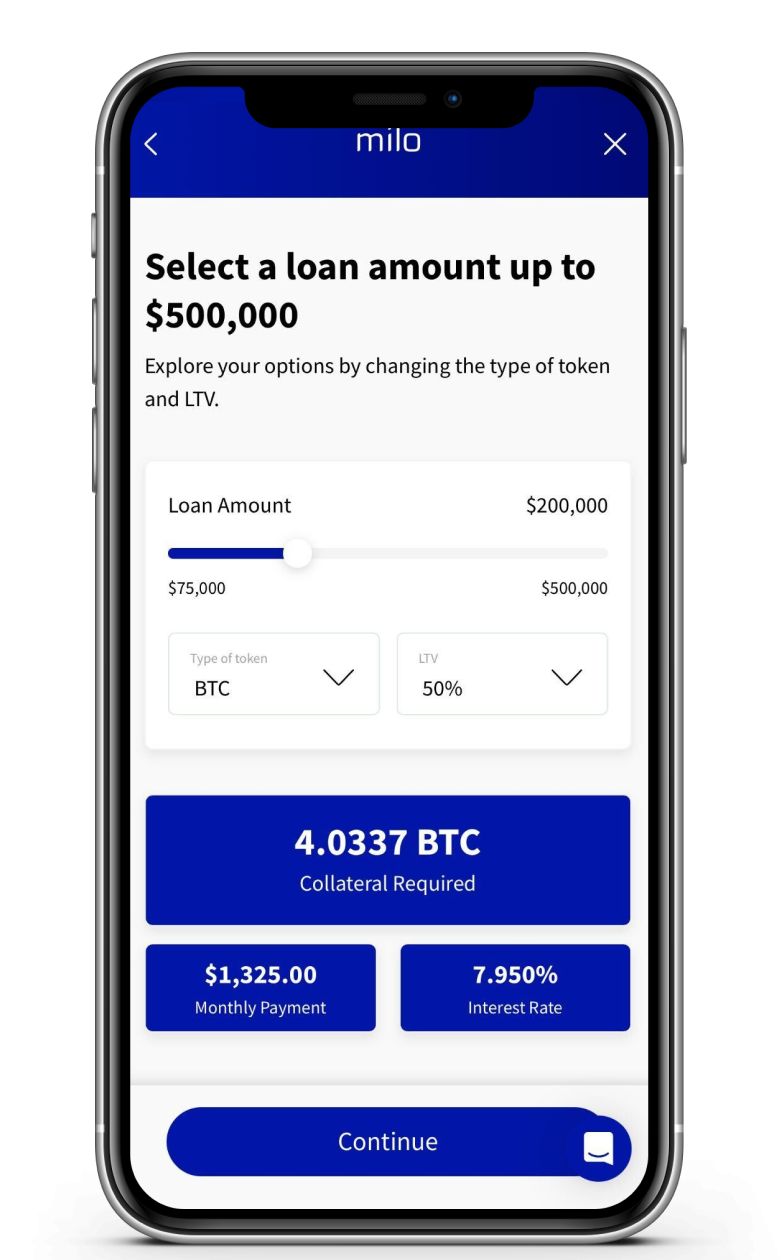

Crypto loan terms

Crypto accepted

Bitcoin & Ethereum

Interest rate

As low as 10.75%*

Collateral

Pledge 2x loan amount

Loan term

1 year, plus extensions

Loan amount

Starting at $75,000

Margin call

67% LTV

Access cash without selling your bitcoin

Low interest rates, secure collateral and no rehypothecation.

* Terms

The loan terms simulated above are based on the price of BTC being $107,549.

Interest rates displayed above and are subject to change without notice and are only indicative.

Monthly payments are interest only followed by a balloon payment at maturity.

Interest rates shown exclude a 5% origination fee. APR starts at 12.75%.

$65M+ in crypto mortgages funded. Now we’re bringing that

expertise to your crypto loan.

Security

Crypto stored with qualified

custodians - Coinbase & BitGo

Low monthly payments

Interest only monthly payments

that work with your budget

Integrity

Client asset safety, no

rehypothecation

Speed

24 hour funding with no credit

checks when you need cash fast

Flexible

No prepayment penalty - pay us

back on your timeline

Transparency

No hidden fees or surprises – all

terms clearly presented upfront