Investment mortgage terms

Recognized reserves

Fiat, Bitcoin & Ethereum

Interest rate

7% - 8%

Custody

Self-custody

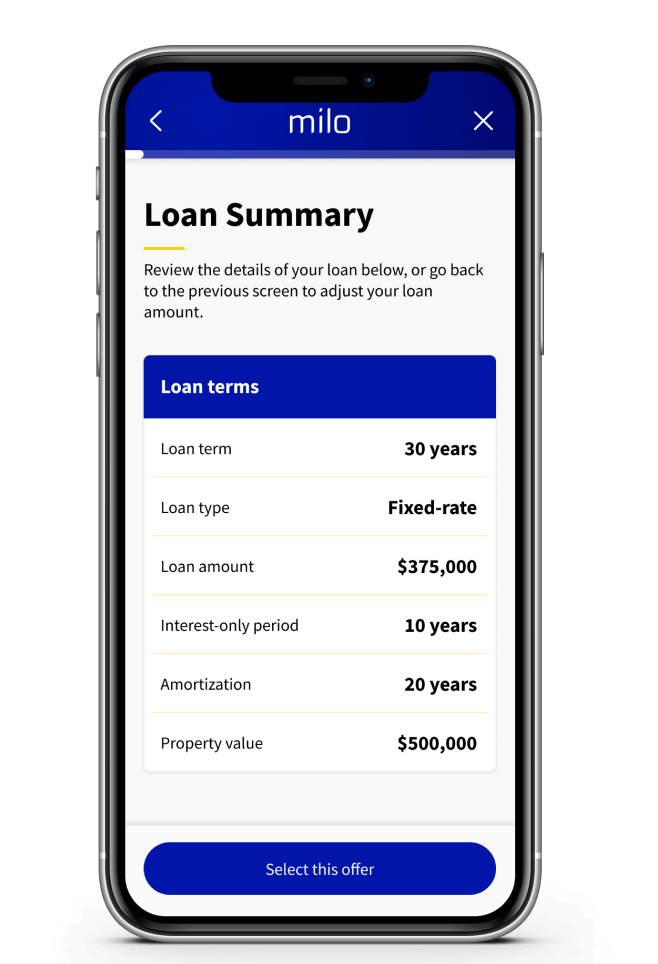

Loan term

30-year fixed, interest only

Loan amount

Starting at $200,000

LTV

Up to 70%

Refinance programs

Rate and term

Refinance

Our rate and term refinance allows you to reduce your monthly payments by lowering your interest rate or extending your term.

Reduce your monthly payments

Extend your term

Close in under 30 days

Cash out

Refinance

Our cash out refinance program is perfect for when you want to maximize your cash out and turn your home equity into cash you can invest today.

Unlock your equity

Extend your term

Close in under 30 days

How we compare to

traditional banks

There are lots of ways to qualify for a mortgage. Milo has numerous options because no two customers are the same.

Qualifying income

Milo

Banks

W-2

Bank statements

Asset utilization

Self-employed

DSCR

What customers are saying

about us

“Pleasure working with the team. They provided such a fantastic experience. Would highly recommend!”

Linda L.

U.S. consumer

“Milo rocks! Highly recommend their loan services, worthy of a 10-star rating!”

Vincent B.

U.S. consumer

“Highly recommend Milo and their team of hardworking and trustworthy professionals.”

Lucas S.

U.S. consumer