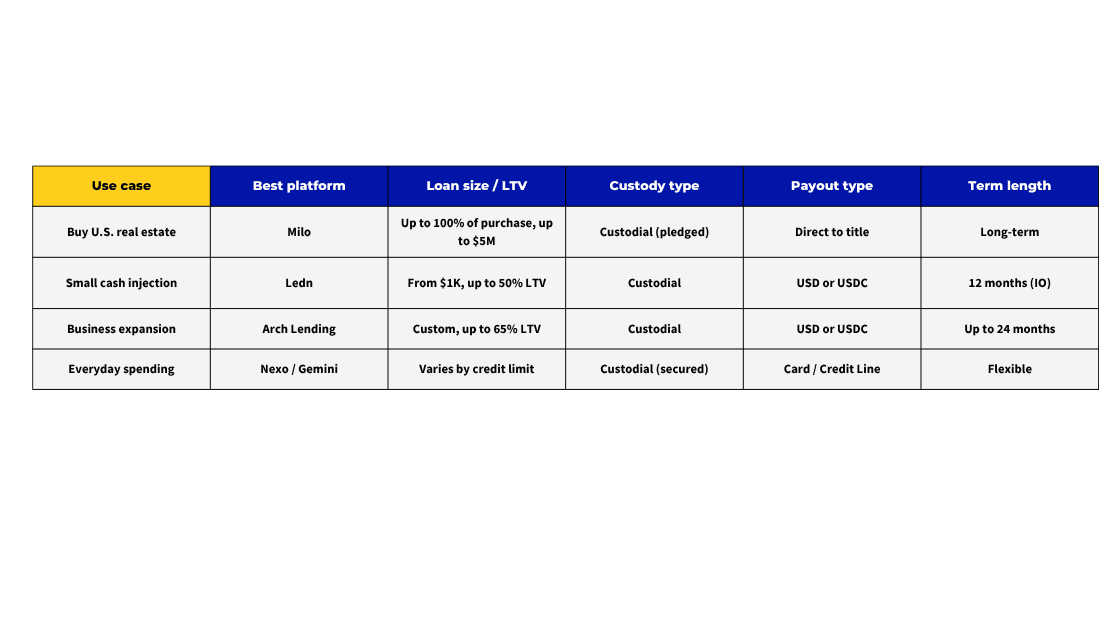

Most crypto lending guides treat all borrowers the same, but the best crypto loan depends entirely on what you're trying to do. Whether you're buying a home, covering a short-term expense, investing in your business, or just want to spend against your crypto, there's no single “best” platform, just the best one for your use case. This guide breaks down today’s top crypto lending platforms based on intent, not just features.

Best crypto loan for buying real estate

Top choice: Milo

If you're looking to buy U.S. property without liquidating your crypto, Milo offers the most purpose-built solution. Our crypto mortgage allows you to pledge your BTC or ETH as collateral and finance up to 100% of the purchase price: a 1:1 collateral-to-loan structure that no other crypto lender offers.

While most crypto-backed loans cap out around 50–65% LTV, Milo lets you borrow based on the full value of the home, dramatically expanding your buying power. We are a regulated U.S. lender designed specifically for real estate investors, with no need for income documentation or asset liquidation.

Why it works for real estate:

- 1:1 collateral to purchase price (up to 100% financing)

- No need to sell crypto or trigger capital gains

- BTC and ETH accepted

- Designed for U.S. properties up to 5 acres

- Option to refinance into a lower rate later

- Low liquidation risk with a healthy margin call buffer

Best crypto loan for small, short-term cash flow

Top choice: Ledn

If you're looking to unlock a small amount of cash fast, Ledn is built for that exact need. With loan minimums starting around $1,000 in BTC collateral, it’s ideal for short-term expenses like covering a bill, bridging a tight month, or deploying capital quickly without selling your crypto.

Ledn offers interest-only loans for up to 12 months, with no prepayment penalties, and funds typically sent within 24 hours. It’s not designed for buying property or long-term investing, but for quick liquidity, it's one of the most accessible options on the market.

Why it works for short-term cash flow:

- Low entry point: ~1K BTC collateral minimum

- Quick funding, often same or next day

- No credit or income checks

- 12-month interest-only term

- Transparent fees, no rehypothecation options available

Best crypto loan for business use

Top choice: Arch Lending

If you're a founder, investor, or business owner with crypto on your balance sheet, Arch Lending is designed with you in mind. Its business-focused loan program accepts BTC, ETH, and SOL as collateral, disbursing funds in USD or USDC with terms up to 24 months.

Unlike platforms focused solely on retail borrowing, Arch offers white-glove onboarding, structured repayment plans, and personalized service. It’s a strong fit for entrepreneurs seeking working capital without giving up ownership of their crypto.

Why it works for business use:

- Built for crypto-native founders and investors

- Accepts BTC, ETH, and SOL

- USD or USDC disbursement

- Custom loan terms up to 24 months

- Concierge support for high-value loans

Best crypto loan for everyday spending

Looking to spend against your crypto without selling it? Nexo and Gemini both offer options for everyday use that feel like traditional financial tools, but powered by your digital assets.

Nexo offers a crypto-backed credit line with no fixed repayment schedule. It’s paired with the Nexo Card, which lets you spend against your collateral instantly and earn up to 2% cashback in crypto. You can switch between credit and debit modes and continue to earn interest on your idle balances.

Gemini takes a slightly different approach with its crypto rewards credit card. It lets you earn up to 4% back in Bitcoin on purchases, making it ideal for users looking to accumulate crypto while spending fiat.

Why it works for everyday spending:

- Use BTC, ETH, or stablecoins as collateral

- Instant credit line (Nexo) or rewards-based spending (Gemini)

- Crypto cashback up to 4%

- No asset liquidation

- Spend globally like a traditional credit card

Choose a crypto loan that matches your goals

Not all crypto loans are created equal, and they’re definitely not one-size-fits-all. The best lending platform depends on how you plan to use the funds:

- Buying real estate? Look for high LTV and low liquidation risk with a healthy margin call buffer.

- Running a business? Prioritize flexibility and disbursement in fiat.

- Need quick cash? Look for small loan minimums and instant approvals.

- Want to spend daily? Credit lines or cashback cards offer seamless options.

Start with your objective. Then choose the platform that fits.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Colin McMahon

Senior Manager, Loan Origination

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.

Related articles

Crypto Mortgage

Best U.S. Crypto Loan Lenders in 2025: Rates & Features Compared

By Colin McMahon

May 14, 2025 • 6 min read

Crypto Mortgage

Crypto loans vs. traditional financing: key differences explained

By Colin McMahon

March 12, 2025 • 8 min read

Learn

The truth about borrowing against digital assets

By Colin McMahon

March 27, 2025 • 6 min read