Back to blogs

Learn

Can Bitcoin qualify you for a mortgage?

By Colin McMahon

September 2, 2025 • 6 min read

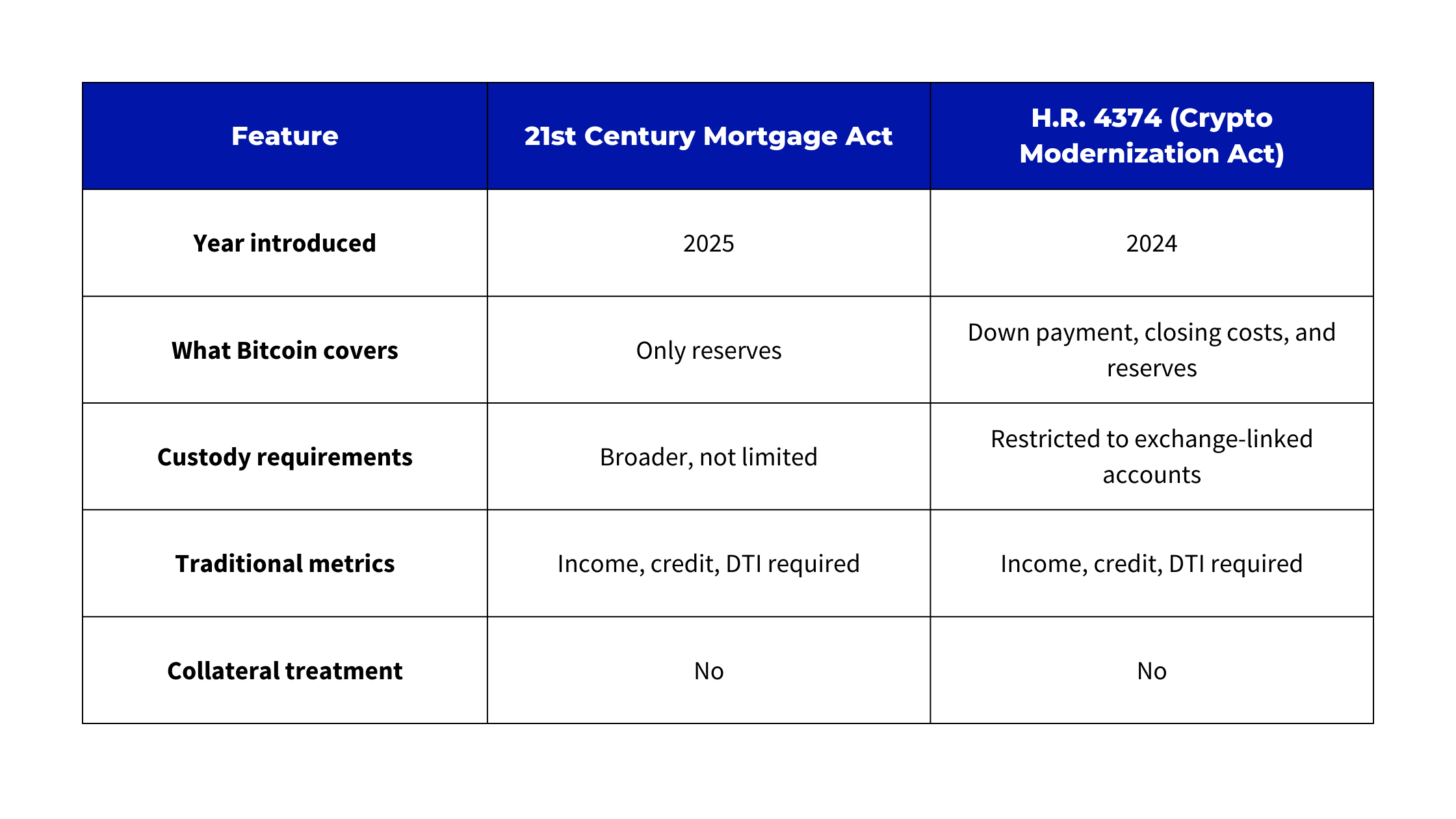

Can Bitcoin qualify you for a mortgage? It is one of the most common questions investors ask as digital assets move closer to mainstream finance. With new legislation like the 21st Century Mortgage Act and the American Homeowner Crypto Modernization Act (H.R. 4374), policymakers are beginning to define how Bitcoin should be treated in the mortgage process.

Both bills represent progress, but neither fully unlocks Bitcoin’s potential. They recognize BTC as part of a borrower’s financial profile, but they stop short of treating Bitcoin as collateral that can directly secure a home loan.

What is the 21st Century Mortgage Act?

The 21st Century Mortgage Act, introduced in 2025, directs Fannie Mae and Freddie Mac to treat Bitcoin as part of a borrower’s reserves. Reserves are funds left over after a borrower pays their down payment and closing costs. Lenders use them as proof the borrower can continue making mortgage payments if their income is interrupted.

Whether reserves are required depends on property type and occupancy:

- Primary residences often do not require reserves unless the borrower’s profile has added risk factors such as higher debt-to-income (DTI) or weaker credit.

- Second homes typically require at least two months of reserves.

- Investment properties almost always require six months or more, especially for borrowers who already own multiple financed properties.

Previously, Bitcoin holdings could not be used for reserves unless converted to cash. The 21st Century Act changes that by allowing BTC to count.

The limitation is that reserves are supportive, not decisive. Borrowers still must qualify through income, credit score, and DTI. If those requirements are not met, Bitcoin reserves alone will not get someone approved.

The bill passed in the House and is currently under review in the Senate.

What is the American Homeowner Crypto Modernization Act?

The American Homeowner Crypto Modernization Act, or H.R. 4374, was introduced in 2024. It aimed to go further than the 21st Century Act by allowing Bitcoin to count as qualifying assets.

Qualifying assets include funds that can be used for down payment, closing costs, and reserves. On paper, this would mean BTC could support more parts of the transaction. But there are key questions that remain unanswered:

- Would BTC be used directly as a down payment, or would it need to be converted into cash?

- Would using BTC for a down payment mean transferring ownership of it?

- How would custody and verification be handled in practice?

What the bill makes clear is that only Bitcoin held in exchange-linked brokerage accounts would qualify. That excludes most of the community who prefer self-custody, multisig, or DeFi. Borrowers would also still have to meet income and DTI requirements.

As of now, H.R. 4374 has not advanced beyond committee hearings.

What these crypto bills accomplish for housing

Both bills represent hopeful progress. They acknowledge Bitcoin as part of the mortgage process without requiring liquidation into cash. This is meaningful in three ways:

- Recognition: Bitcoin is officially validated within U.S. housing finance.

- Flexibility: Borrowers can meet certain requirements with BTC, reducing friction.

- Symbolism: Policymakers are signaling that digital assets are part of the future of homeownership.

Still, neither bill solves the affordability challenge. Both keep income and DTI requirements intact, and both still require cash for down payment and closing costs.

What is a bitcoin mortgage? How does it differ?

A bitcoin mortgage is fundamentally different from the bills under review because it treats Bitcoin as collateral, not just as a supporting asset. Instead of being recognized passively, BTC actively secures the loan, just as the property itself would in a traditional mortgage.

Milo is the only company in the U.S. offering an operational bitcoin-backed mortgage. Here is how it works in practice:

- Pledge Bitcoin: Borrowers place BTC with a qualified custodian to secure the loan.

- Access 100 percent financing: Because the loan is fully collateralized, there is no need for a cash down payment.

- Buy a home immediately: Financing can be used for a primary residence, second home, or rental property.

- Overcome traditional barriers: Borrowers are not constrained by income or DTI requirements, creating a path to ownership that would otherwise be blocked.

This is not a conceptual framework or a proposal waiting for approval. Milo’s bitcoin mortgage is a live product already helping buyers enter the housing market without selling their Bitcoin. For many, it directly addresses the affordability challenge in ways no current or proposed legislation can.

Bitcoin mortgage vs new crypto bills: what’s the real difference?

The 21st Century Mortgage Act and H.R. 4374 show positive momentum. They recognize Bitcoin within the U.S. mortgage system. But both remain limited: reserves in one case, qualifying assets in the other, with no collateral treatment in either.

For borrowers, this means:

- Cash is still required for down payment and closing costs.

- Income and DTI rules still apply.

- Bitcoin strengthens a file but does not open financing directly.

A bitcoin mortgage, by contrast, uses BTC as collateral. That removes the need for down payments, sidesteps income hurdles, and creates a real opportunity for homebuyers today.

The bottom line: these bills are a step in the right direction, but for Bitcoin holders asking if BTC can qualify you for a mortgage, the only operational solution right now is a bitcoin mortgage.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Colin McMahon

Senior Manager, Loan Origination

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.

Related articles

Learn

The crypto mortgage bill explained: what it solves and what it doesn’t

By Josip Rupena

July 23, 2025 • 8 min read

Crypto Mortgage

Qualify for a mortgage with crypto and keep full custody

By Colin McMahon

June 4, 2025 • 6 min read

Crypto Mortgage

Selling BTC for real estate vs a crypto-backed mortgage

By Josip Rupena

August 8, 2025 • 4 min read