Back to blogs

Learn

Fannie and Freddie to count crypto reserves in mortgages

By Josip Rupena

August 21, 2025 • 8 min read

Editor's Note (February 2026): This article was originally published in August 2025 and reflects the legislative landscape at that time. The status of H.R. 4374 and related crypto-reserve policies may have changed. We will update this post as the legislation progresses.

Senator Cynthia Lummis introduced the 21st Century Mortgage Act of 2025 to modernize how Fannie Mae and Freddie Mac handle digital assets. It is proposed legislation, not law. The Senate bill amends only the charters of the government-sponsored enterprises (GSEs), while a separate House bill takes a broader approach across multiple housing agencies. Together, these proposals show how policymakers are beginning to address the role of digital assets in the U.S. housing market, and the rest of this article explains how the Senate bill works in practice.

The 21st Century Mortgage Act bill explained

The bill defines digital assets as fungible, blockchain-based tokens and excludes digital collectibles or tokens that only represent other assets. It requires that Fannie Mae and Freddie Mac consider digital assets as reserves, without converting them to U.S. dollars. These assets cannot count as income or a down payment unless exchanged into dollars.

To qualify, the assets must be held in a qualified custodial arrangement, such as a U.S. regulated custodian or a multi-party structure with enforceable U.S. governance. The GSEs must also apply risk haircuts. This means they will discount the value of a borrower’s crypto holdings to account for volatility, liquidity, and concentration. For example, if you hold $10,000 in eligible crypto, only a portion of that might count as reserves depending on how the GSEs set their methodology.

The bill also requires Fannie Mae and Freddie Mac to periodically review and update these adjustments, ensuring reserve treatment evolves with market conditions. Importantly, any methodology must first be approved by the GSE’s board of directors and then submitted to the Federal Housing Finance Agency (FHFA) for review. This governance requirement puts checks around how digital assets are recognized.

Finally, the act would amend the underlying statutes that created Fannie Mae (12 U.S.C. §1717(b)) and Freddie Mac (12 U.S.C. §1454), embedding digital asset treatment directly into their legal authority.

How reserves work in mortgage underwriting

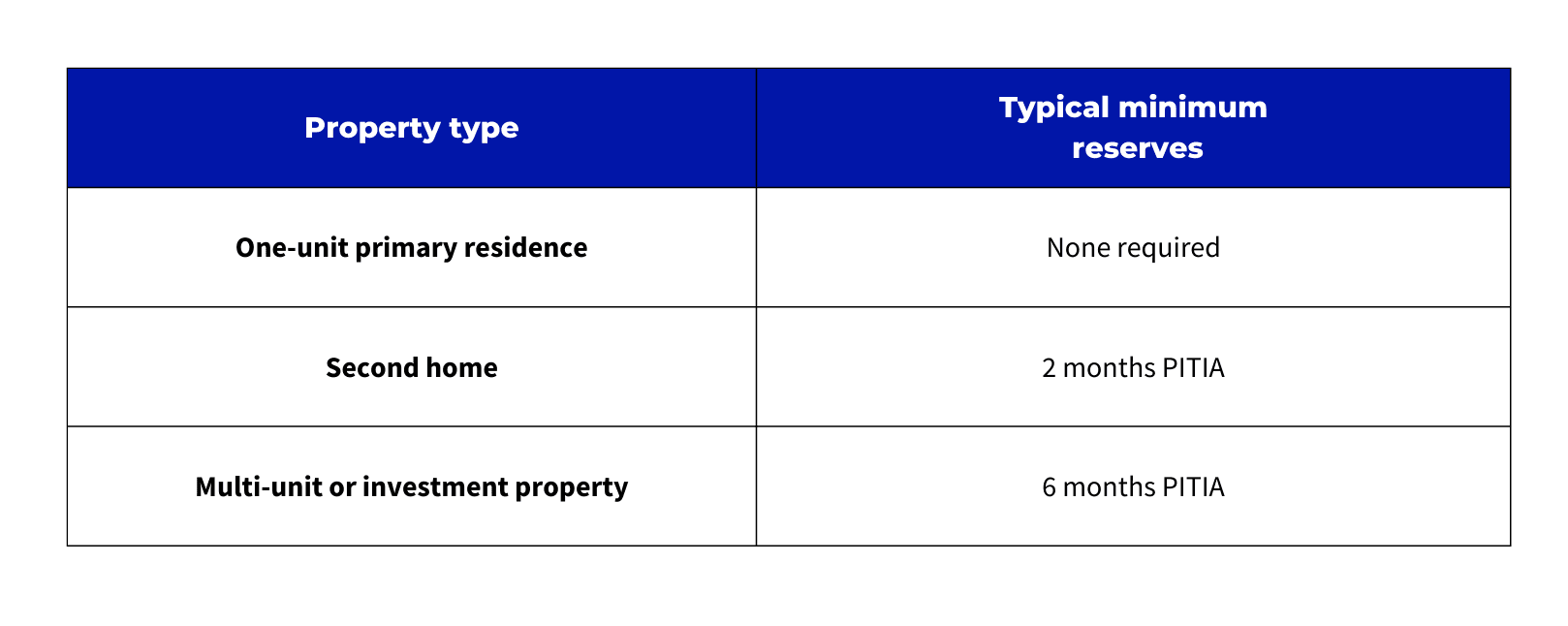

Reserves are funds a borrower must have after closing, typically measured in months of mortgage payments (principal, interest, taxes, insurance or PITIA). Examples:

Desktop Underwriter (DU), Fannie Mae’s automated underwriting system, or Loan Product Advisor (LPA), Freddie Mac’s equivalent, may still request reserves on a primary residence if risk factors stack up. For example:

- An investor with multiple properties applying for a new loan may need six months of reserves.

- A borrower on the edge of approval might see DU require a few months of reserves. In that case, custodied crypto could fill the gap under this bill.

How (or if) the bill applies to you

-

If you are buying a second home or investment property and your approval is borderline, your digital assets could now count toward required reserves without being sold.

-

If you are a first-time buyer with good credit and an acceptable debt-to-income ratio (DTI) buying a primary home, you typically will not need reserves, so this change will not affect your approval even if you hold significant crypto.

-

If your main obstacle is down payment or income, counting digital assets as reserves does not resolve that constraint.

Bigger picture

The FHFA has already signaled interest in letting GSEs include crypto reserves; this bill would make that direction permanent. The House bill, however, takes a broader approach. It directs multiple housing agencies, not just Fannie Mae and Freddie Mac, to consider digital assets held in brokerage accounts when lenders assess eligibility. The Senate bill rewrites the GSE charters and focuses narrowly on reserves without conversion. The House bill pushes for a wider adoption across housing programs.

The Senate bill modernizes how digital assets are treated in reserve calculations. It introduces governance requirements, mandates ongoing review of reserve methodologies, and embeds these changes directly into the GSE charters. It is a technical update that can make a difference for certain borrowers, particularly those buying second homes or investment properties with borderline underwriting. It does not change income verification, down payment requirements, or primary home approval paths. The contrast between the Senate and House bills highlights two approaches: one targeted to GSE reserves and one aiming for broader recognition of brokerage-held digital assets across programs.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Josip Rupena

CEO / Founder at Milo

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.

Related articles

Learn

The crypto mortgage bill explained: what it solves and what it doesn’t

By Josip Rupena

July 23, 2025 • 8 min read

Crypto Mortgage

Crypto just got a seat at the mortgage table, but we built the house

By Josip Rupena

June 26, 2025 • 6 min read

Learn

Can Bitcoin qualify you for a mortgage?

By Colin McMahon

September 2, 2025 • 6 min read