Back to blogs

Crypto Mortgage

How to borrow against your crypto without losing control

By Milo

October 16, 2025 • 6 min read

Self-custody is having a moment. The headlines cite a crypto mortgage bill and the ads say you keep control. Read the fine print. A second signature, a pause switch, or an oracle trigger means shared custody. You can still unlock liquidity without surrendering keys. Use crypto as reserves in true self-custody, avoid margin call mechanics, and pursue financing on your terms. This article decodes the jargon and maps the real trade-offs.

What is self-custody

Self-custody means you alone control the private keys that move your assets. No platform, lender, custodian, or contract guardian can transfer or freeze funds without your independent consent. In practice, you generate and store your own keys, you can initiate transactions at any time, and your ability to transfer is limited only by network rules and your security practices.

It is not custody at an exchange where the platform holds the keys. It is not a multisig where a lender or administrator controls one of the signatures. It is not a smart contract escrow that can be upgraded, paused, or redirected by an external key holder. These can be useful for different goals, but they are forms of shared control.

Key terms to read the fine print

- Custody: Who can move your coins. If a second signature exists, control is shared.

- Rehypothecation: Whether a custodian can reuse client assets. If allowed, counterparty exposure rises.

- Oracle risk: On-chain price feeds that programmatically trigger actions in smart contracts. Delays or errors can force sells.

- Price-feed risk: Off-chain market data used by centralized programs to compute loan-to-value and margin calls. Stale or stressed feeds can misfire.

- Liquidation: A program’s rules to sell collateral when LTV thresholds are breached.

- Proof from your wallet: Showing balances and ownership from a self-custody wallet without transferring assets.

Use crypto as reserves while keeping self-custody

Using crypto as reserves lets you keep assets in your own wallet while still strengthening a financing application. The assets are not pledged and do not move to a custodian. Instead, you document what you hold and that you control it.

In practice, you provide evidence that specific addresses belong to you and that balances meet policy. The lender evaluates those reserves as part of your overall profile. You keep unilateral control throughout. There is no collateral transfer and no margin-call mechanism because nothing is subject to programmatic sale.

The policy discussion matters. Current proposals and public guidance indicate lenders may consider digital assets in underwriting. This does not force acceptance of every asset or chain, and it does not standardize documentation overnight. It does validate the premise that reserves held in self-custody can be recognized without turning them into pledged collateral.

Pledging crypto as collateral

Pledging is the classic crypto-backed approach. Assets move to a qualified custodian or controlled contract, and the lender advances funds against a target loan-to-value. Done well, it can be robust. Institutional custodians typically offer segregation, audited controls, insurance coverage, and deep cold storage that many personal setups cannot match. With a conservative LTV, a healthy price buffer, and clear top-up windows, pledged structures can reduce operational friction, simplify funding, and lower the cash needed at close.

There are trade-offs. You give up unilateral control of keys and accept program rules on transfers and releases. Pricing and LTV monitoring rely on aggregated market data feeds. During fast markets, feed dislocations can trigger margin calls or liquidations. For borrowers seeking maximum proceeds and institutional-grade protections, that exchange can be sensible. For those who prioritize absolute control, reserves in self-custody remain the cleaner fit.

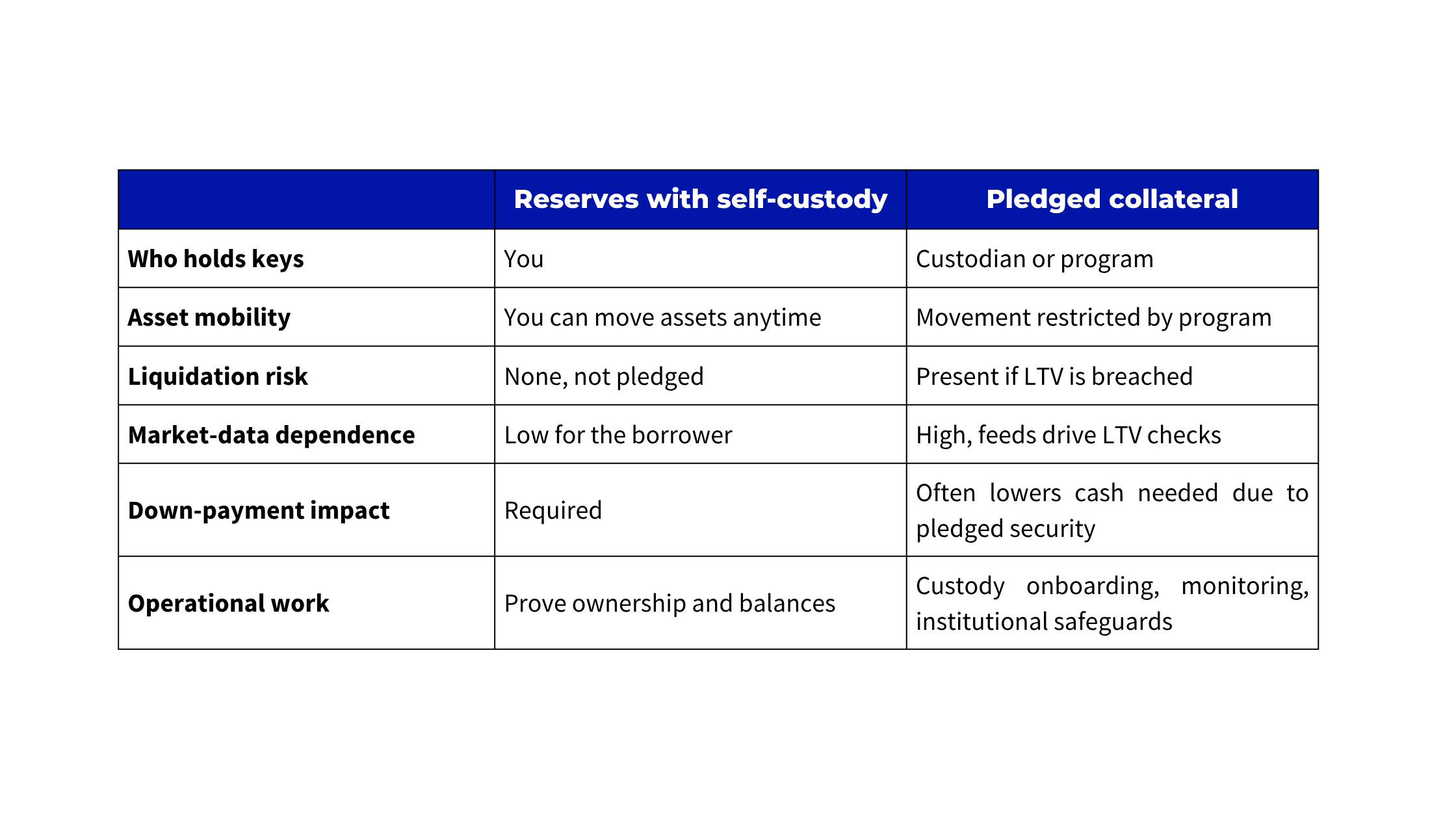

Reserves versus pledge at a glance

How to spot marketing spin

Some programs describe shared control as self-custody. A simple reading of the structure reveals the truth.

- A second signature is required to move funds. That is co-custody, not self-custody.

- An on-chain escrow includes upgrade keys or admin pause rights. That is shared control.

- “No rehypothecation” is claimed, but assets sit in an omnibus wallet without clear segregation. Ask for specifics.

- Pricing and margining depend on opaque market-data sources. Ask who runs them, how they are aggregated, and what the failover is.

If any answer is unclear, you are not in full self-custody.

The bottom line

You do not need to sell coins to access financing, and you do not need to surrender keys to prove strength. If control is your priority, treating crypto as reserves while keeping self-custody allows you to pursue financing without collateral transfers or margin-call mechanics. If maximizing proceeds is the priority, a pledged structure can work as long as you accept program custody and data-driven liquidation rules.

Milo supports both paths. When you are ready to compare, run the scenarios side by side and choose the structure that matches how you actually manage your crypto.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.