Back to blogs

Learn

Should you choose a crypto loan or a HELOC in 2025?

By Colin McMahon

July 10, 2025 • 6 min read

In 2025, homeowners are increasingly using home equity to access capital. HELOC balances surged by $6 billion in Q1, marking the 12th straight quarterly rise. Americans now tap into their $35 trillion in equity as a financial lifeline. While interest rates on HELOCs sit around 8.27 percent, the appeal is understandable: funding renovations, paying debt, or exercising financial flexibility. Against this backdrop, crypto-backed loans, enabled by record growth in crypto-collateralized lending, offer an alternative that appeals to crypto investors. Q1 data shows crypto-backed loans for real estate rose 333 percent year‑over‑year.

As both options gain traction, it’s worth comparing them comprehensively, so you can see which offers a better fit for your situation.

What is a HELOC?

A Home Equity Line of Credit is a revolving credit line secured by your home. You can borrow up to your approved limit during the draw period (typically 5–10 years), paying interest only on what you use. After that, the repayment period kicks in (usually 10–20 years), requiring you to pay both principal and interest.

Key Features:

- Collateral: Your home (forms a second lien)

- Approval: Based on home equity, income, credit score, DTI

- Interest rate: Variable (Prime + margin), currently ~8.27 percent average

- Costs: Low to no closing costs; annual fees possible

- Use cases: Renovations, debt consolidation, emergencies

- Risks: Variable rates, potential foreclosure

Why borrowers choose HELOCs now:

- Trillions in equity available

- Cheaper than credit cards (20%+)

- Popular for debt repayment and home upgrades

What is a crypto loan?

A crypto loan lets you borrow cash using your Bitcoin or Ethereum as collateral, without selling your holdings. Your crypto is held securely by a custodian (e.g., BitGo), and you receive a lump sum in USD.

Key Features:

- Collateral: Crypto (Bitcoin or Ethereum)

- Approval: Instant, based on collateral, not income or credit

- Loan term: Typically 12 months (renewable)

- Interest rate: Fixed (ranges from 10 - 14% depending on the lender)

- APR: Ranges from 12 - 15% depending on the lender (includes origination fees)

- Funding time: Instant approval, funds in as little as 24 hours

- Repayment: Interest-only payments; principal due at maturity

- Risks: Margin call if crypto value drops; collateral is at risk, not your home

Why more people are turning to crypto loans:

- Ease of qualification. No income documents required to transact

- Offers liquidity without liquidating crypto or triggering taxes

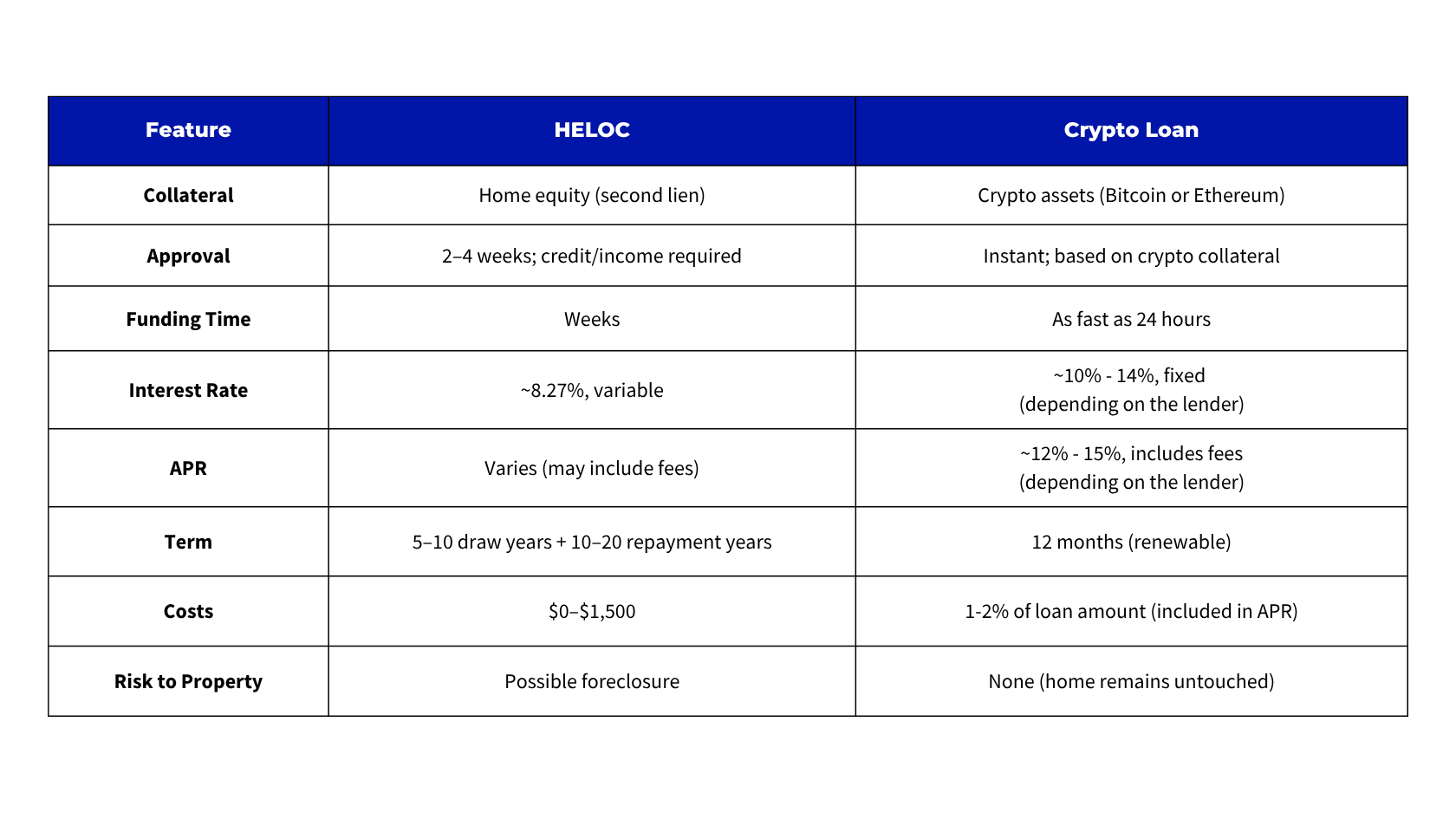

Comparing crypto loans and HELOCs

Why more borrowers are turning to crypto loans in 2025

While HELOCs have grown in popularity this year, they still fall under the umbrella of traditional lending, meaning they come with the same underwriting hurdles as a mortgage. Borrowers must provide income documentation, undergo credit checks, and meet strict debt-to-income (DTI) thresholds. For many investors, especially those with high asset levels but non-traditional or inconsistent income, this scrutiny becomes a barrier. Even with significant home equity, they’re often disqualified because their income doesn’t fit a conventional mold.

That’s where crypto loans are shifting the landscape. In 2025, more borrowers are turning to crypto-backed loans to access liquidity without triggering a sale or getting blocked by outdated lending frameworks. Like Milo’s crypto mortgage product, a crypto loan allows borrowers to qualify based on their assets, not their income. There’s no need to show W-2s, tax returns, or navigate DTI calculations. Approval is based solely on the value of pledged crypto, and funding can happen in as little as 24 hours. For investors who believe in the long-term growth of their digital assets and want to retain exposure while gaining access to capital, this structure is more aligned with how they operate.

As crypto adoption grows and traditional lenders remain cautious, asset-based financing offers a more modern solution, one that’s faster, simpler, and designed around the needs of today’s crypto investor.

Why would I get a crypto loan instead of a HELOC?

Protects your home Your property remains unencumbered. Even if you miss payments, only your crypto collateral is at risk, no lien against your home.

Speed and simplicity Skip appraisals, titles, income docs. Approval is instant, and funds arrive in as little as 24 hours.

No income checks Ideal for investors, entrepreneurs, or anyone whose income isn’t traditional. No credit score or bank statements required.

Fixed, predictable rates With fixed interest, budgeting is easier. No surprise payments if interest rates rise.

Tax-efficient liquidity Borrowing doesn’t trigger capital gains. Your crypto stays intact, preserving long-term gains

When does a HELOC make more sense?

- You don’t hold crypto

- You want a lower upfront rate and are fine with variable interest

- You need long-term access to funds over several years

- You’re comfortable using your home as collateral and managing longer repayment timelines

Bottom Line With rising HELOC utilization and widespread interest, it’s clear many homeowners see home equity as a safety net. But for crypto holders seeking fast, short-term liquidity without touching their home or selling assets, a crypto-backed loan often provides a better fit. It combines speed, simplicity, and asset protection, ideal when time is short and flexibility is key.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Colin McMahon

Senior Manager, Loan Origination

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.

Related articles

Crypto Mortgage

Crypto loans vs. traditional financing: key differences explained

By Colin McMahon

March 12, 2025 • 8 min read

Crypto Mortgage

How to buy a home with a crypto loan

By Colin McMahon

May 29, 2025 • 6 min read

Crypto Mortgage

Crypto loan vs crypto mortgage: which is right for you?

By Colin McMahon

March 6, 2025 • 6 min read