Back to blogs

Learn

Why Milo partners with Coinbase for crypto custody

By Josip Rupena

August 6, 2025 • 8 min read

If you're a long-term crypto holder, you're likely cautious about where your assets go, how they're handled, and who has access. That caution makes sense; self-custody has long been the standard for those who value control, transparency, and security.

At Milo, we work with crypto clients every day who ask the same question before applying: What actually happens to my crypto if I use it as collateral for a mortgage?

This article explains why we chose Coinbase Custody Trust Company as one of our primary institutional partners, how our custody model works, and what protections are in place to ensure your assets remain fully segregated, secure, and in your control throughout the life of your mortgage.

Why we never self-custody your crypto

Milo does not custody your crypto. Your assets are never held in Milo-owned wallets or pooled with our company reserves. We intentionally separate custody from lending to protect you.

This separation matters. It means your collateral is never exposed to Milo’s business operations, internal risk, or balance sheet. Your crypto is custodied with a regulated third party, not with us.

This structure ensures that your assets are protected even if Milo experiences operational changes. Your crypto never becomes an unsecured asset on our books; it stays yours, fully segregated, in cold storage.

Why we chose Coinbase Custody

Coinbase Custody is one of the most trusted names in digital asset protection, not because of brand recognition alone, but because of its regulatory status, institutional safeguards, and proven cold storage infrastructure.

Here’s why we selected them:

1. Qualified custodian status

Coinbase Custody operates as a New York State-chartered trust company, regulated by the New York Department of Financial Services (NYDFS). That makes it a qualified custodian under the Investment Advisers Act of 1940.

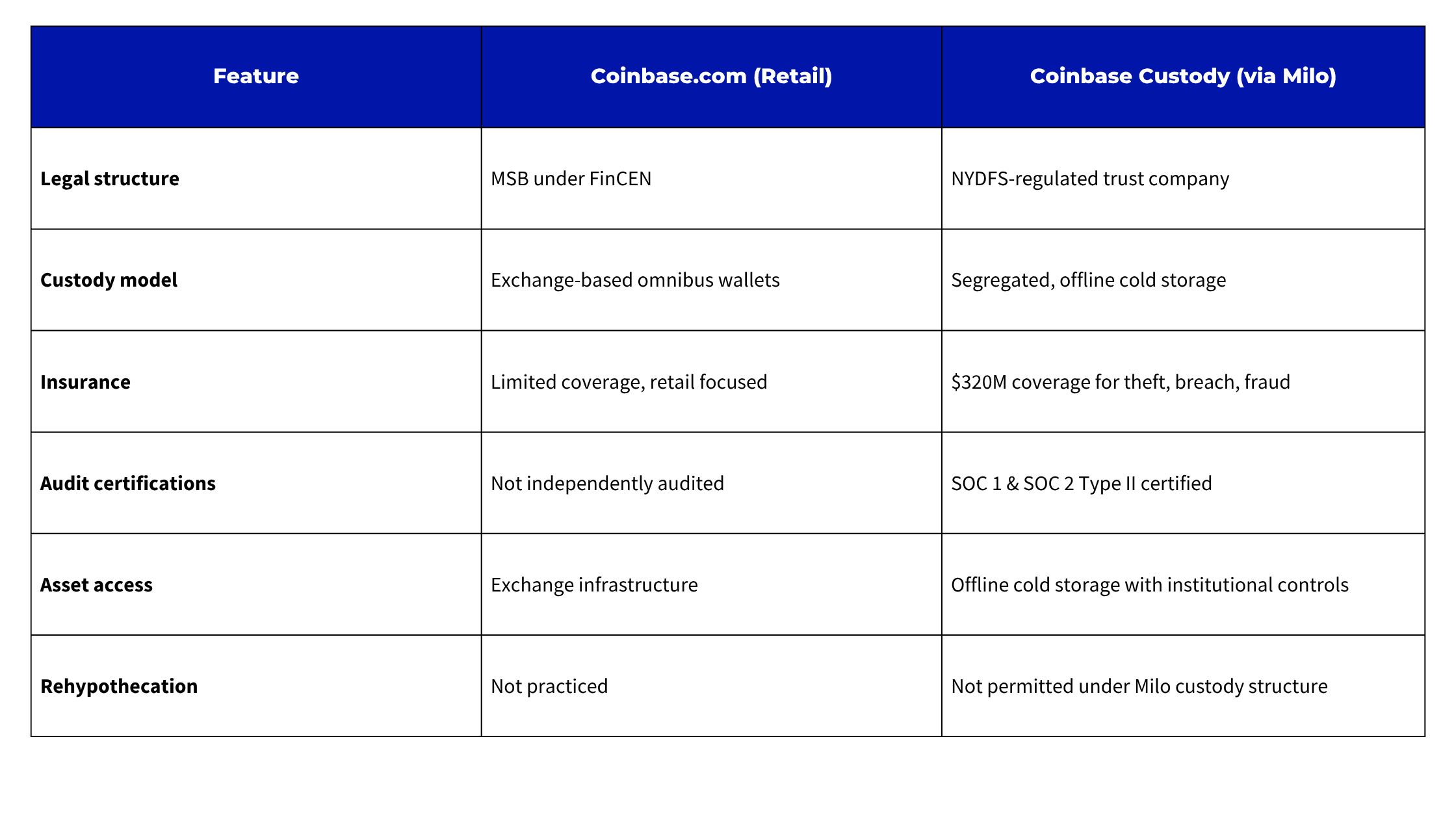

This designation means Coinbase Custody must meet strict legal obligations regarding client asset segregation, financial audits, and operational controls. In contrast, Coinbase’s retail platform operates as a Money Services Business (MSB) under FinCEN, which does not require the same level of custody oversight. While MSBs can hold and move funds, they are not held to the same legal and fiduciary standards that protect institutional assets.

Qualified custodians are bound by law to safeguard client assets separately from their own operations. That’s the level of protection you get when your crypto is held with Coinbase Custody through Milo.

2. Cold storage as the standard

All assets are stored offline, in geographically distributed, air-gapped vaults using enterprise-grade security protocols. Coinbase Custody’s infrastructure is built for institutional clients and has never experienced a breach of client funds held in cold storage.

This is materially different from wallets held on exchanges or apps. Assets are secured in offline custody with strict internal controls, physical protections, and continuous oversight, designed to safeguard large balances at scale.

3. SOC 1 Type II and SOC 2 Type II certified

These are third-party audits that test the design and performance of Coinbase Custody’s internal controls.

- SOC 1 Type II evaluates how Coinbase’s systems handle financial transactions and reporting accuracy.

- SOC 2 Type II reviews the effectiveness of Coinbase’s security, availability, processing integrity, and confidentiality systems over time.

The “Type II” designation is critical: it means these controls aren’t just documented, they’re tested and verified over a sustained period. Very few platforms in crypto hold both of these certifications.

4. $320 million in insurance coverage

Coinbase Custody maintains a comprehensive insurance policy that covers theft, cyber breaches, internal fraud, and key compromise. It is one of the largest insurance policies in the industry dedicated to digital asset storage.

5. Built for institutions

Coinbase Custody is not the same as holding crypto on Coinbase.com. It is a separate legal entity with a separate regulatory framework, separate infrastructure, and a client base composed entirely of institutional platforms, ETF issuers, hedge funds, and qualified custodial partners like Milo.

We don’t just use Coinbase because it’s well-known. We use it because it’s built to protect large, high-value client holdings at scale.

How Coinbase Custody differs from holding crypto on coinbase.com

Many clients tell us, “I already use Coinbase. Isn’t this the same?” The answer is no. Here’s how they differ:

When you hold assets on Coinbase.com, your funds may be pooled with other users’ assets and subject to exchange-level risks. When you use Milo, your crypto is fully separated, professionally managed, and regulated as institutional custody.

Security incidents that have impacted Coinbase in the past have been tied to the retail exchange platform, not to Coinbase Custody Trust Company.

What happens to your crypto (and when)

Unlike most lending platforms that require you to transfer assets upfront, often before final terms are clear, Milo structures the process differently:

1. No transfer at application We use secure, read-only wallet verification to assess your eligibility. You keep full custody during underwriting.

2. Test transaction before closing Once approved, we request a small test transaction to confirm wallet setup and verify movement controls.

3. Collateral transfer only at closing The full collateral transfer happens only once the loan is finalized and ready to close.

4. Custodied 1:1 at a regulated trust Your assets are held in cold storage, under your name, at a 1:1 value relative to your loan. Milo cannot access, move, or use those funds for any other purpose.

This structure eliminates the uncertainty or loss of control clients often experience with other crypto lending platforms. You know where your assets are at every step, and they remain yours.

What you still control

Milo’s crypto mortgage is designed to let you finance real estate without selling your crypto or losing long-term upside. Here’s what remains in your hands:

-

You retain exposure to crypto gains If your crypto increases in value while in custody, that appreciation belongs to you.

-

You benefit from property appreciation As the homeowner, you also gain from any increase in the value of the real estate.

-

Request access to the excess collateral If the value of your crypto substantially exceeds your loan’s coverage ratio, you can request access to a portion of the excess on an annual basis, subject to loan performance and market conditions.

-

Collateral is released at payoff At the end of the loan term, once your balance is paid, your crypto is returned in full, subject to final confirmation. No conversions, no forced selling.

And yes, we also work with BitGo BitGo Trust Company is another one of our custody partners, trusted by institutions globally for its regulated cold storage infrastructure and insurance protections. It has been securing digital assets for over a decade and provides the same core values we prioritize: offline security, regulatory oversight, and strict separation of client funds.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Josip Rupena

CEO / Founder at Milo

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.