What’s a crypto refinance?

Our crypto refinance enables borrowers to cash-out up to 100% of their property’s appraised value by pledging their crypto assets. Explore our BTC and ETH refinance programs to see which collateral option works best for you.

Benefits of a

crypto refinance

Keeping your crypto is just as important as buying it. Unlock your property’s equity without having to sell your crypto.

Refinance up to $5 million

For investment properties

Borrow up to 100%

Maximize your cash-out

Quick application

100% online

Safe & trusted custodian

BitGo and Coinbase

Diversify your portfolio

Access cash and invest

Collateral accepted

BTC and ETH

What can your home

equity do for you?

By leveraging your crypto and home, you can access amazing fixed rates depending on your financial situation.

Loan amount

$1,000,000

Crypto value required

$1,000,000

Rate

Fixed

Term

30 years

Interest-only period

10 years

Closing time

2 - 4 weeks

Loan example based on a $1,000,000 refinance.

How it works

Qualify in minutes, pledge crypto with our reputable,

insured custodian and close in weeks!

Qualify in minutes, pledge crypto with our reputable, insured custodian and close in weeks!

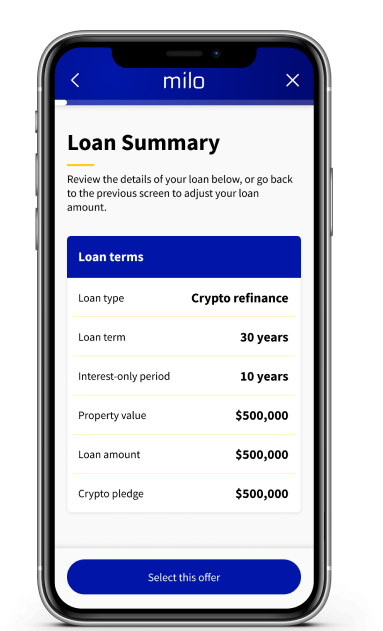

1.

Select your offer

2.

Sign your loan agreement

3.

Pay for an appraisal

4.

Deposit your collateral

5.

Close your mortgage