Back to blogs

Learn

Don’t confuse a crypto loan with a crypto mortgage

By Colin McMahon

June 30, 2025 • 8 min read

Understanding the confusion

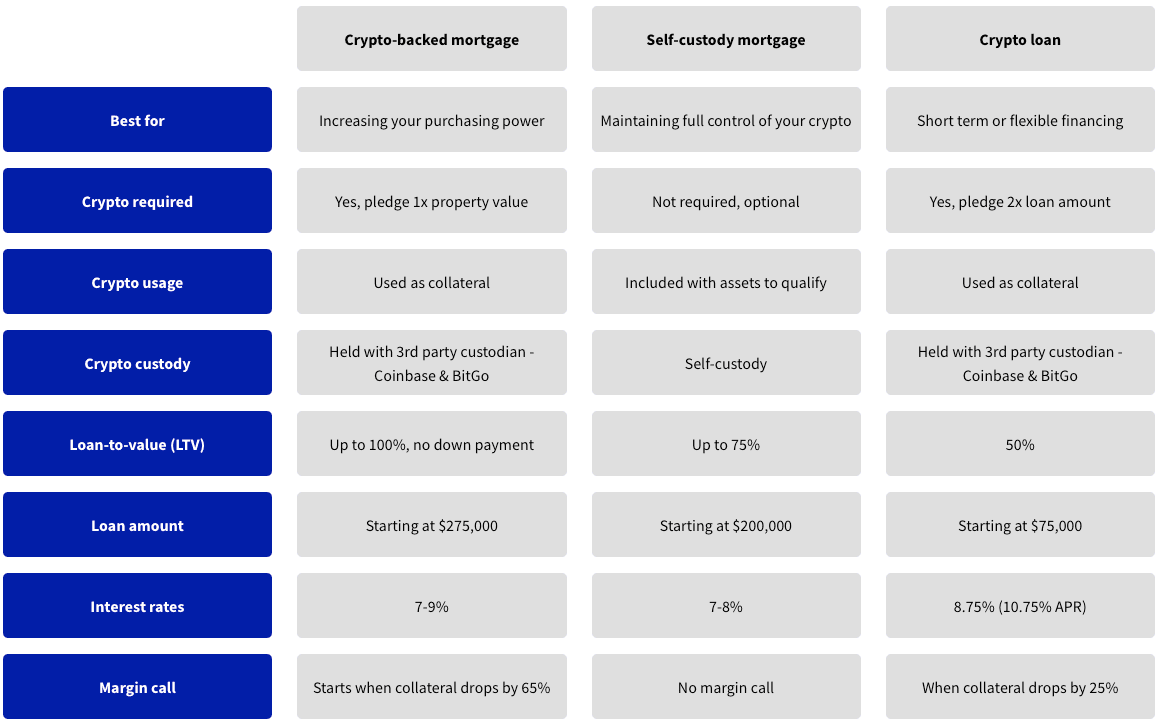

At Milo, we offer both a Crypto Mortgage and a Crypto Loan, and while they both involve using your crypto, they serve completely different purposes. The confusion typically starts when people assume “crypto loan” is just another way of saying “crypto mortgage.” That’s not the case.

Terms like crypto mortgage or bitcoin mortgage refer specifically to our 30-year mortgage product for buying or refinancing U.S. property. A crypto loan, on the other hand, is a separate offering with a short-term structure and entirely different use cases.

What Is a Crypto Mortgage?

A crypto mortgage is designed for individuals purchasing or refinancing U.S. real estate who want to use their crypto wealth as part of the transaction without selling it. The structure is a 30-year loan with interest-only payments for the first 10 years, followed by 20 years of amortized payments.

Your crypto is used as collateral, and the property you’re purchasing also serves as collateral. That dual-collateral structure allows for a more efficient loan-to-value ratio, typically 1:1, compared to the 2:1 collateralization required for crypto loans. Some programs also support self-custody, meaning you don’t have to transfer your crypto if you meet specific criteria.

This product is purpose-built for long-term financing. It provides stability, lower rates, and a clear path to real estate ownership in the U.S.

What Is a Crypto Loan?

A crypto loan gives you short-term liquidity using your BTC or ETH as collateral. The term is 12 months with interest-only monthly payments, and the crypto must be placed in custody with providers like BitGo or Coinbase.

While it’s not a mortgage, it can support a property purchase, for example, by covering a down payment, helping you make a competitive cash offer, or bridging timing gaps for flippers and real estate investors. However, it cannot be used for refinancing a property and does not involve real estate as additional collateral.

The structure reflects the purpose. You’re pledging 2x the collateral for a 50% LTV loan. For instance, borrowing $800,000 would require $1.6 million in BTC or ETH. Rates for crypto loans start at 10.75% APR, and industry averages are typically in the 13–14% range unless you pledge more than a 2:1 ratio. This makes it best suited as bridge financing or a short-term solution, not a replacement for a mortgage.

Why it matters

Using a crypto loan when you're really in need of a mortgage can lead to sticker shock, greater capital requirements, and unnecessary friction. Each product was built with different goals in mind. The crypto mortgage is a long-term solution optimized for property ownership. The crypto loan is a shorter-term tool best used when you have a defined exit strategy, whether that’s a refinance, a sale, or future capital coming in.

Crypto Mortgage vs. Crypto Loan

Which one is right for you?

Choose the crypto mortgage if your goal is long-term property ownership. You're comfortable pledging your crypto and property for a 30-year commitment, and you want the flexibility of interest-only payments early on, plus the stability of traditional mortgage terms.

Choose the crypto loan if you need short-term access to capital and already have a plan in place for what happens next. This might include using the funds for a down payment, bridging a real estate investment, or taking advantage of a time-sensitive opportunity, all without selling your crypto. Just know that this loan is temporary by design, and the higher APR and collateral requirements reflect that.

Still unsure which fits your goals? 👉 Explore your options

We’ll guide you to the right product based on how you want to use your crypto and where you're headed next.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Colin McMahon

Senior Manager, Loan Origination

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.

Related articles

Crypto Mortgage

Crypto loan vs crypto mortgage: which is right for you?

By Colin McMahon

March 6, 2025 • 6 min read

Crypto Mortgage

Crypto Loans for Real Estate: Loan vs Mortgage Explained

By Colin McMahon

May 15, 2025 • 6 min read

Crypto Mortgage

How to buy a home with a crypto loan

By Colin McMahon

May 29, 2025 • 6 min read