Back to blogs

Crypto Mortgage

Crypto Loans for Real Estate: Loan vs Mortgage Explained

By Colin McMahon

May 15, 2025 • 6 min read

Table of contents

- What is a crypto loan, and how can it help you buy a home?

- How can a crypto loan help with debt consolidation?

- What is a crypto mortgage, and when does it make sense?

- Crypto loan vs crypto mortgage: what’s the difference?

- Which option is right for your real estate plans?

- What if I don't want to give up my self-custody?

If you’ve ever wondered, “Can I use my Bitcoin to buy a home?”—the short answer is yes.

But the longer answer is that the path you take depends on the type of property, your goals, and how you want to use your crypto.

At Milo, we often hear this question from crypto investors exploring ways to enter the real estate market without selling their assets. The good news is, there are two options: a crypto loan or a crypto mortgage. While they might sound similar, they serve different needs and work in very different ways.

Let’s break it down.

What is a crypto loan, and how can it help you buy a home?

A crypto loan is a fast, flexible way to convert your Bitcoin or Ethereum into cash without selling it. It works as an interest-only loan, where your crypto is securely locked as collateral, and you receive cash that can be used toward a primary home purchase, down payment, or even debt consolidation.

Key facts about Milo’s crypto loan program:

- Interest rate starting at 8.75%, offering some of the lowest monthly payments in crypto lending today; or the option of no monthly payments at all.

- The APR starts at 10.75% and the 2% origination fee is already built into the APR—no upfront payment is required.

- Interest-only payments for the duration of the loan.

- Crypto stays locked in secure custody for the full loan term.

- Can be used for primary home purchases, down payments, or liquidity to support mortgage qualification.

How can a crypto loan help with debt consolidation?

Some borrowers also use crypto loans to consolidate higher-interest debts, potentially reducing monthly payments and improving their financial profile when applying for a primary home mortgage with a traditional lender.

But it’s important to be clear. A crypto loan is still a new loan, and it shows up as a liability on your balance sheet. While it can help lower your monthly obligations by replacing higher-interest debts with a crypto loan, it doesn’t automatically improve your debt-to-income (DTI) ratio unless structured carefully.

That said, Milo’s crypto loan offers some of the lowest monthly payments in crypto lending today due to its lower interest rate. This means the loan can have less of a negative impact on your DTI compared to other crypto loans in the market, especially when used to consolidate higher-cost debts.

Still, borrowers should work closely with their mortgage consultant to ensure this strategy is being applied effectively and that the crypto loan is contributing to a better overall qualification profile, rather than simply shifting the structure of the debt.

In short, it’s a useful tool, but like any loan, it needs to be used with intention and a clear plan.

What is a crypto mortgage, and when does it make sense?

A crypto mortgage is a longer-term option designed specifically for investment properties and second homes, giving you a way to use your crypto as collateral while purchasing real estate.

Key facts about Milo’s crypto mortgage program:

- Rates around 7-9% APR, with a 2% origination fee.

- Crypto is locked only during the prepayment penalty period, and can be returned after (terms and conditions apply).

- Ideal for second homes and rental properties.

- Structured like a traditional mortgage with monthly payments and longer terms.

This lets you keep your crypto while investing in real estate, helping you diversify your holdings without fully exiting your position.

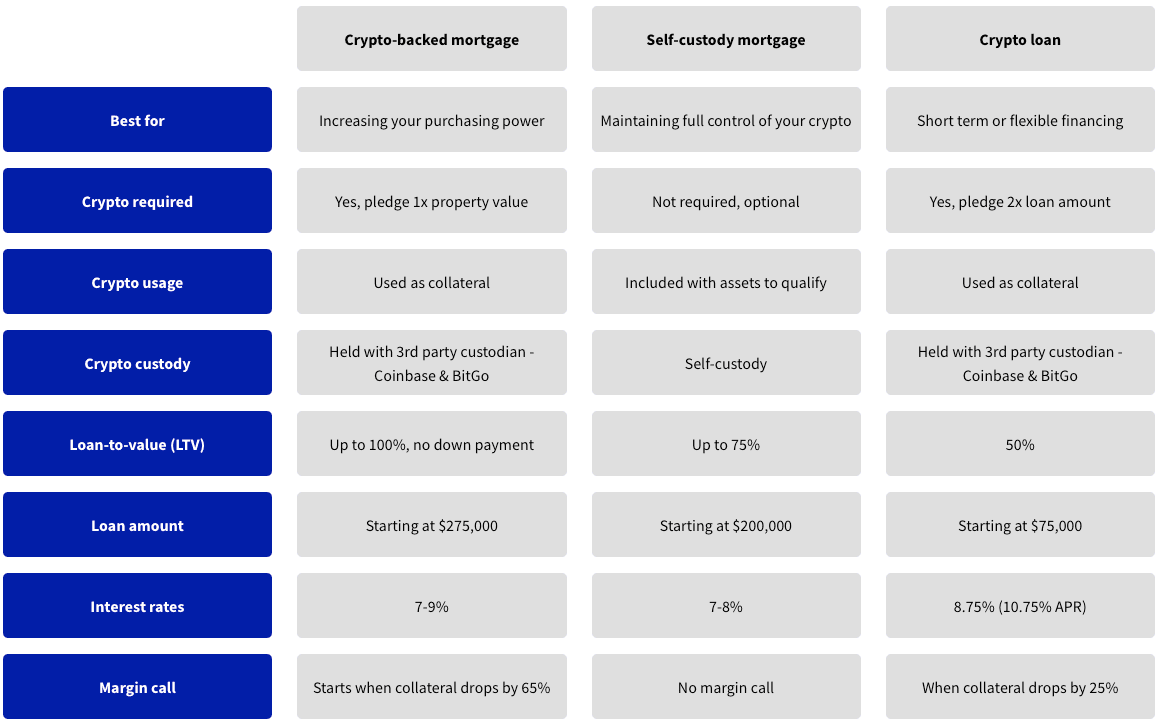

Crypto loan vs crypto mortgage: what’s the difference?

Which option is right for your real estate plans?

If you’re looking to buy a primary home, cover a down payment, or access liquidity to help qualify for a better mortgage, a crypto loan offers the flexibility and speed you need. For investors purchasing second homes or rental properties, a crypto mortgage provides a longer-term solution, allowing you to use your crypto for real estate investment while keeping your assets working for you.

Both tools give you access to real estate markets without selling your Bitcoin or Ethereum, but they’re designed for different scenarios.

What if I don't want to give up my self-custody?

If keeping control of your crypto is a non-negotiable for you, there’s another option to consider.

Milo also offers an investment mortgage, which works much like a traditional mortgage but with a crypto-friendly twist.

This program lets you use your crypto wealth as qualifying reserves, rather than as collateral. That means you keep your assets in your own custody, and we recognize them when evaluating your mortgage eligibility.

Key facts about Milo’s investment mortgage program:

- Interest rates between 7-8%.

- Up to 70% loan-to-value (LTV).

- Crypto stays in your self-custody and is used only as reserves to support qualification, not as pledged collateral.

Just like with traditional mortgages, it’s not enough to cover the down payment and closing costs—you also need to prove you have enough reserves to cover several months of payments.

Most lenders require reserves equal to six months of housing payments, and Milo follows a similar approach.

Where we differ is that, unlike traditional banks, we recognize your Bitcoin, Ethereum, and other crypto holdings as part of those reserves, helping crypto investors qualify without needing to liquidate or move assets into fiat.

It’s a practical option for real estate investors who want to use their crypto wealth to strengthen their mortgage application while maintaining self-custody and control over their assets.

Final thoughts Crypto loans and crypto mortgages are helping investors use their digital assets in the real world, especially for real estate transactions.

At Milo, our crypto loan is designed for primary home purchases and liquidity needs, while our crypto mortgage is focused on investment properties and second homes.

As the space evolves, we look forward to expanding into dedicated primary home crypto mortgage products, giving crypto investors even more ways to put their assets to work.

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Colin McMahon

Senior Manager, Loan Origination

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.

Related articles

Crypto Mortgage

How to buy a home with a crypto loan

By Colin McMahon

May 29, 2025 • 6 min read

Crypto Mortgage

How to use Bitcoin for a down payment on a home

By Colin McMahon

April 17, 2025 • 8 min read

Crypto Mortgage

Crypto loan vs crypto mortgage: which is right for you?

By Colin McMahon

March 6, 2025 • 6 min read