Back to blogs

Learn

The crypto mortgage bill explained: what it solves and what it doesn’t

By Josip Rupena

July 23, 2025 • 8 min read

Table of contents

- What Is the American Homeowner Crypto Modernization Act of 2025?

- What are reserves in mortgage lending?

- What the crypto mortgage bill changes, and what it doesn’t

- Who benefits from the crypto mortgage bill?

- What the crypto mortgage bill doesn’t cover

- Comparing Milo's crypto mortgage to the crypto mortgage bill

- Frequently asked questions

- Final Takeaway

What Is the American Homeowner Crypto Modernization Act of 2025?

In July 2025, lawmakers introduced H.R. 4374, formally titled the American Homeowner Crypto Modernization Act of 2025. This proposed legislation instructs federal mortgage agencies, including Fannie Mae, Freddie Mac, the VA, and USDA, to update their underwriting standards to accept cryptocurrency held in regulated custodial brokerage accounts as part of the mortgage approval process.

Commonly referred to as the crypto mortgage bill, it represents the federal government’s first formal effort to integrate crypto assets into traditional real estate financing. Specifically, the bill would allow crypto to count toward reserve requirements, which are often essential for mortgage approval.

What are reserves in mortgage lending?

Reserves are funds a borrower must show to prove they can continue making mortgage payments even in the event of a financial disruption. These reserves are usually calculated as 6 to 12 months of PITIA: Principal, Interest, Taxes, Insurance, and Association dues.

Historically, lenders have not accepted crypto as a reserve asset unless it was first converted to fiat and held in a bank account for a set period, known as a seasoning period. The crypto mortgage bill eliminates that barrier for borrowers whose assets are held in a regulated custodial account.

How will your crypto be valued in the mortgage process?

While the crypto mortgage bill does not define a haircut, lenders are likely expected to apply a discount when evaluating crypto asset values due to price volatility. This is standard practice in underwriting for non-cash assets.

For example:

- If you hold $100,000 in BTC, a lender may apply a 30% haircut

- Only $70,000 would be counted toward reserves

- Real-time or near-real-time pricing would likely be required

- Agencies may require additional documentation or daily balance verification

Haircuts help account for market fluctuation and are similar to how restricted stock or retirement accounts are treated today.

What the crypto mortgage bill changes, and what it doesn’t

The crypto mortgage bill requires that all qualifying crypto assets be held in a regulated custodial brokerage account. This includes custodians such as Coinbase Custody, BitGo, and Fidelity Digital Assets, which meet U.S. standards for asset security, reporting, and transparency. If your crypto resides in a self-custody wallet like Ledger, Trezor, or MetaMask, those assets must be transferred to an approved custodian to qualify.

This requirement matters because holding patterns vary widely. Many crypto users prefer cold storage for control and security, especially after exchange failures. However, assets stored this way do not qualify under the crypto mortgage bill unless they are moved into compliant custody beforehand. For borrowers considering crypto-based mortgages, understanding both where and how your crypto is stored can make all the difference in whether it counts for reserves or not.

Who benefits from the crypto mortgage bill?

The crypto mortgage bill is most useful for:

- Crypto holders using regulated custodial platforms

- Borrowers who have the liquidity to cover a downpayment, but not enough fiat for reserves

- Buyers who want to avoid liquidating crypto and the tax impact that comes with it

- Borrowers applying for government-backed or QM loans who need reserve verification

If you meet all other traditional requirements but are blocked by reserve documentation, this bill could help you qualify, as long as your crypto is held with a compliant custodian.

What the crypto mortgage bill doesn’t cover

While the bill solves for reserves, it does not cover:

- Income qualification: crypto cannot be counted toward Debt-to-Income (DTI)

- Down payments: borrowers still need to fund this portion with fiat

It’s a helpful step for crypto adoption in mortgage lending, but many buyers need more flexibility than what the crypto mortgage bill currently allows.

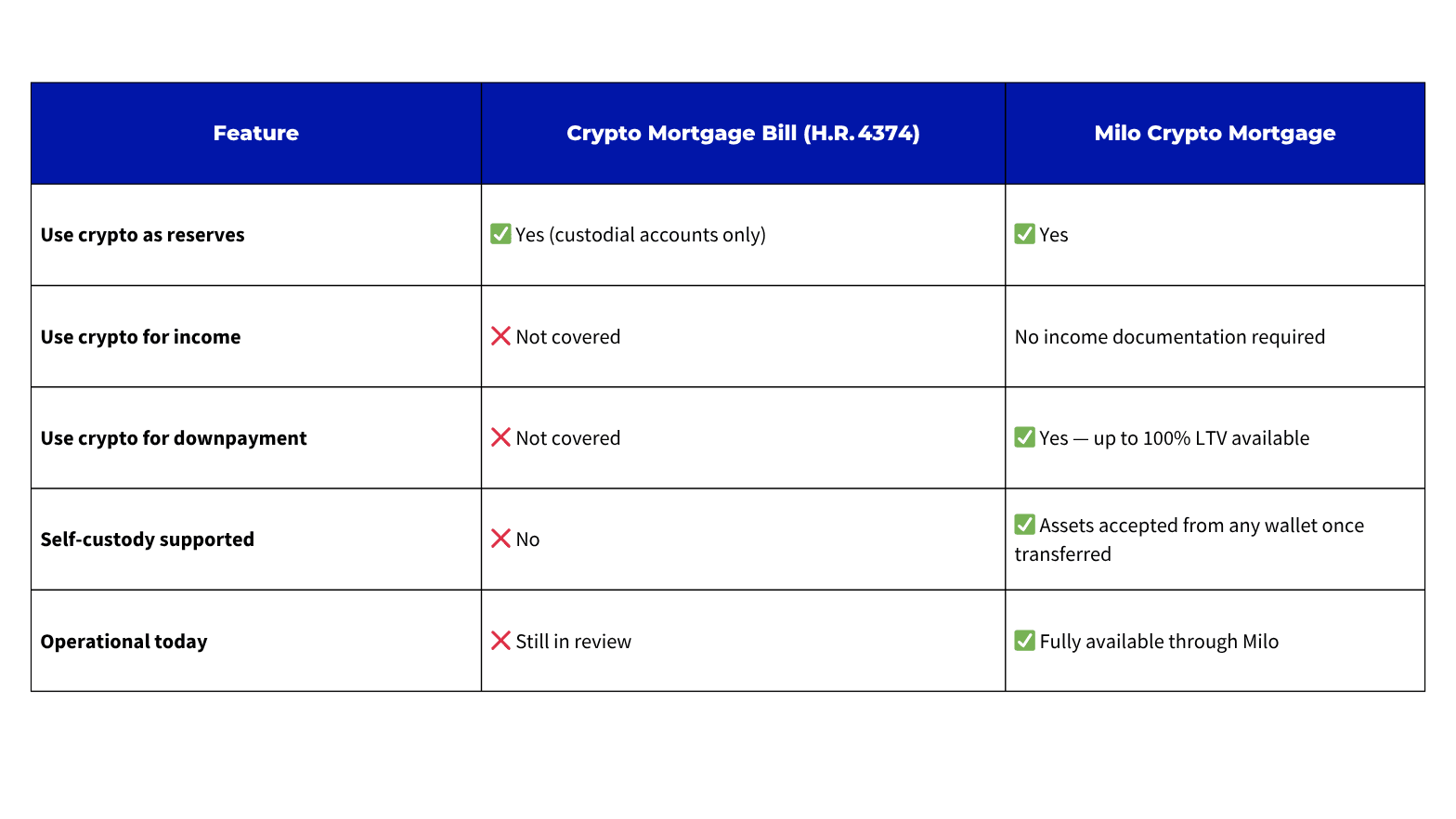

Comparing Milo's crypto mortgage to the crypto mortgage bill

While the crypto mortgage bill helps solve for reserves, Milo’s crypto mortgage addresses the full spectrum of what crypto investors need to purchase real estate today.

We allow borrowers to qualify based on their Bitcoin or Ethereum holdings, without needing to convert their assets or submit income documentation. Milo uses a 1:1 qualification model, where the value of your crypto directly determines how much home you can afford.

Importantly, you qualify before transferring your assets. Once qualified, the transfer to Milo’s regulated custodian happens as part of the closing process. This means you don’t need to move funds prematurely and can complete your transaction with full transparency.

We do check credit history, and borrowers must be in good credit standing, but there is no DTI requirement. Most clients use our 100% LTV option, meaning no fiat downpayment is needed. This allows you to preserve liquidity, avoid triggering capital gains, and finance the property entirely with the strength of your crypto holdings.

Check eligibility in your state → (scroll to the bottom of the page)

Frequently asked questions

Can I use crypto to qualify for a mortgage today? Yes. Milo is the only regulated U.S. lender currently offering a crypto mortgage. You can qualify using your BTC or ETH without selling.

Does the crypto mortgage bill let me use crypto as income? No. It only allows crypto to be counted as reserves, not for DTI or income purposes.

What wallets are accepted under the crypto mortgage bill? Only crypto held in regulated custodial brokerage accounts is eligible. Self-custody wallets must be transferred before they count.

How does Milo qualify crypto holders for a crypto mortgage? Milo uses a 1:1 qualification model that values your crypto prior to transfer. You qualify based on asset value, and we verify through our secure custodian during the closing process.

Final Takeaway

The crypto mortgage bill is an encouraging signal that crypto is becoming part of the financial mainstream. It addresses one challenge, reserves, but stops short of solving for downpayments, DTI, or self-custody.

Milo’s crypto mortgage program already solves all three. We enable borrowers to qualify based on their digital assets, preserve their holdings, and access real estate financing without compromise.

Explore Milo’s Crypto Mortgage →

The opinions expressed in the Blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Author

Josip Rupena

CEO / Founder at Milo

Subscribe to our newsletter

Actual crypto success stories and strategies straight to your inbox.